Conservation easements are an excellent method for maintaining ownership of one’s land while not only prohibiting development but also receiving tax benefits. A conservation easement is a legally-binding agreement between a property owner and a nonprofit organization or a government agency that restricts development on the land covered by the easement. Usually the landowner receives tax benefits in exchange for the conservation easement but sometimes they can receive a one-time payment made by the organization to purchase the easement. Donating land via a conservation easement can provide estate tax, income tax, and property tax benefits.

A conservation easement is created like any other permanent interest in land, by having both parties agree to and sign a contract, which is recorded in the land records. Most easements “run with the land,” binding the original owner and, more importantly, all subsequent owners to the easement’s restrictions. The terms of a conservation easement are set jointly by the landowner and the entity that will hold the easement. They are designed to meet the needs of both parties by targeting only those rights (e.g., commercial development) necessary to accomplish specific conservation objectives.

The property owner who places a conservation easement on their land retains partial ownership rights over the land but relinquishes certain rights to use the property. Even the most restrictive easements typically permit landowners to continue such traditional uses of the land as farming and ranching. Conservation easements can take many forms, including:

- a limitation on the property’s use,

- a limitation on the number of building sites on an undeveloped real estate parcel,

- a prohibition against depleting the land’s natural resources, such as timber, and

- a prohibition against fishing or hunting.

Contributions of a qualified real property interest to an organization for conservation purposes can result in a charitable deduction from income tax (IRC § 170(h)(1)). A qualified real property interest for this purpose can be the taxpayer’s entire interest in the property, a remainder interest, or an easement that restricts the use of the property in perpetuity. Conservation purposes under IRC § 170(h)(4)(A) are (1) preserving land for outdoor recreational use by, or education of, the general public; (2) protecting relatively natural habitats of fish, wildlife or plants; (3) preserving open space (including farmland or forest space) for scenic enjoyment of the general public or under a governmental conservation policy yielding significant public benefit; and (4) preserving a historically important land area or a certified historic structure.

Conservation easements may also lead to a reduction in property tax. Property tax assessment is usually based on the property’s market value, which reflects the property’s development potential. If a conservation easement reduces the development potential of the property, it may reduce the level of assessment and the amount of the owner’s property taxes. The actual amount of reduction, if any, depends on many factors. State law and the personal attitudes of local officials and assessors may influence or determine the decision to award property tax relief to easement grantors.

First enacted temporarily in 2006, new tax incentives for conservation easements were made permanent in 2015 and increased the benefits to landowners by: 1) raising the deduction a donor can take for donating a conservation easement to 50%, from 30%, of his or her annual income; 2) extending the carry-forward period for a donor to take a tax deduction for a conservation agreement to 15 years from 5 years; and 3) allowing qualifying farmers and ranchers to deduct up to 100% of their income, increased from 50%.

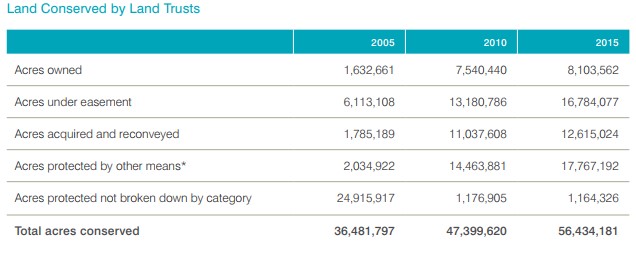

The increase in tax benefits for conservation easements created a dramatic increase in the amount of land subject to a conservation easement.[1]

For size comparison, that is an area twice the size of all the national parks in the contiguous United States and larger than the entire State of Minnesota, which contains approximately 55 million acres.

Land subject to conservation easements can be bought or sold, but the restrictions remain in perpetuity. The idea is often appealing to farm families who want to continue a farming operation over future generations, but need financial assistance from the immediate benefits of cash paid for the conservation easement[2], the short-term benefit of the tax deduction for a charitable donation, or the long term savings from the reduction in property taxes. There are also those who wish to protect the natural character of land from any future development. In either case, while current cash or tax advantages provide immediate benefits to the present landowner, future generations and owners carry the costs in terms of restrictions and limited land development opportunities.

[1] Land Trust Alliance, 2015 National Land Trust Census Report, 5, https://www.landtrustalliance.org/land-trusts/land-trust-census/2015-final-report

[2] Although not common, there are instances where a conservation easement will be purchased by a private environmental organization rather than being donated by the landowner to the organization or to a government entity. The Nature Conservancy is one of the most active in this area.